Online Identity Verification

Stratton partners with Jumio so you can know and trust your customers online

with the AI-driven identity verification

Automated Identity Verification, Risk Assessment and Compliance

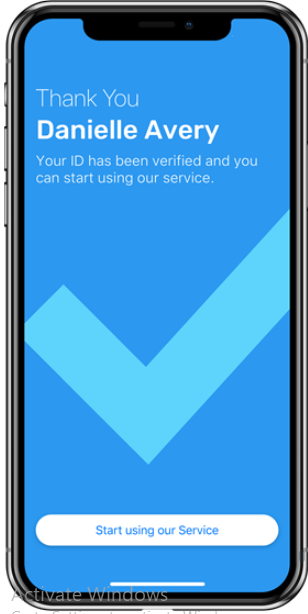

Onboard new customers faster and keep fraudsters off your platform with identity verification.

Services include verifying the user’s ID, comparing it to their selfie, determining whether the person is physically

present and not a deepfake, collecting supplemental documentation such as utility bills, authenticating users when

they return to your platform, and more.

The Jumio software in numbers…

Yes. This is why we choose them!

Yes. This is why we choose them!

1B+

Transactions

processed

5K+

ID types in over 200

countries and territories

500+

Best-in-class global

data sources

Automate and Simplify Identity Verification

Jumio Identity Verification solutions use artificial intelligence, machine learning and biometrics to automate the

verification process and help companies improve conversion rates, comply with AML and KYC regulations and better

detect fraud — all while delivering a definitive, risk-based answer in seconds.

ID Check

Is the identity document (ID)

authentic and valid?

Selfie + Liveness Check

Is the person holding the ID the

same person shown in the ID

photo? Are they physically present

during the transaction?

Risk-based Decision

Jumio calculates the fraud risk and

approves or rejects the identity

transaction in seconds based on

your predefined risk tolerances.

Identity Verification Services

ID Verification

Is this a genuine ID?

Prompts your customers to take a

photo of the front and back of their

identification document (such as a

driver’s license or passport) or provide

a trusted digital ID, then uses

sophisticated algorithms to detect

fraud.

Selfie Verification

Is this person the same as the

person on the ID?

Prompts your customer to take a selfie

to ensure the person you’re onboarding

is the same as the person on the ID.

Liveness Detection

Is the person physically present?

Uses advanced facial biometrics to

ensure the selfie is taken of a live

person, not a photo, video or deepfake.

Doc Proof

Can they provide additional

documentation?

Allows your customers to upload

supporting documentation such as

utility bills or credit card and bank

statements. Jumio can automatically

extract data from that documentation

and verify the document’s authenticity.

Video Verification

Can I interview them live or take

video of their onboarding journey?

For the highest level of security, the

entire onboarding process can be

conducted and/or captured via video.

Authentication

Is this the same person who

opened the account

When an existing user returns to your

platform, make sure they’re the same

person who onboarded

Solution Highlights

User Experience

Dramatically reduce user friction and

verification time while increasing

conversion rates.

Compliance

Comply with KYC, AML, CCPA, GDPR

and many more privacy and financial

services regulations and directives.

Course Correction

Reduce abandonment rates by enabling

your users to retake a picture of their ID

or selfie if the initial image is unreadable.

Security

All data is transmitted and stored with

strong AES 256-bit encryption. Jumio

is PCI-DSS Level 1 compliant.

Automatically Verify IDs

Ensure secure ID document

authentication by checking against

known ID templates to ensure that all

the requisite security checks (e.g.,

holograms, watermarks, font types,

etc.) are present.

Advanced Liveness Check

Perform liveness detection using

advanced face-based biometric

technology for spoof-proofing.

Fraud Deterrence

Subjects users to a brief liveness

check, which serves as a powerful

fraud deterrent for many scammers

who prefer not to share their own

likeness with the company they’re

looking to defraud.

Speak to our team today to find out more

Contact Us

For questions, technical assistance, or collaboration opportunities contact us

via the form or information provided.

- +44 1992 240030

- +44 203 150 0578

- enquiries@strattonnetworks.co.uk

- Elstree Film Studios, Shenley Road, Borehamwood, Herts, WD6 1JG